REIT 101: Unlock Income from Your Equity While It Vests

The Problem: Equity-Rich, Cash-Flow Poor

You've worked hard to earn equity compensation—RSUs, stock options, or vesting shares. But there's a catch: while your equity grows on paper, it's locked up and generating zero income until it vests. You can't touch it, can't spend it, and can't invest it.

Meanwhile, you're missing out on income-generating opportunities like REITs that could be putting money in your pocket today.

What if you could earn yields from high-quality real estate investments without selling your equity or missing out on its upside potential?

That's where Equity Earn comes in—and where understanding REITs becomes crucial to maximizing your financial strategy.

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. Created by Congress in 1960, REITs allow investors to earn dividends from real estate investments without having to buy, manage, or finance properties themselves.

Think of a REIT as a mutual fund for real estate—it pools capital from numerous investors to purchase and manage a diversified portfolio of income-generating properties.

Why REITs Are Perfect for Equity Compensation Holders

The Traditional Problem

When you have equity compensation:

❌ It's locked until vesting

❌ It generates no current income

❌ You can't diversify without selling (and losing upside)

❌ You miss years of potential dividend income

The Equity Earn Solution

With Equity Earn, you can:

✅ Use unvested equity as collateral to borrow

✅ Invest borrowed funds into income-generating REITs

✅ Earn REIT dividends immediately

✅ Keep 100% upside when your equity vests

✅ Generate cash flow without being trapped in locked positions

How REITs Work

REITs follow a straightforward business model:

Investors purchase shares in the REIT

The REIT uses that capital to acquire, develop, or finance real estate assets

Properties generate income through rent, lease payments, or mortgage interest

The REIT distributes income to shareholders as dividends

Key Legal Requirement: REITs must distribute at least 90% of their taxable income to shareholders annually as dividends. This means consistent, high-yield income—typically 3-7% annually or more.

Types of REITs for Your Portfolio

Understanding the different types of REITs helps you build a diversified portfolio that matches your income goals and risk tolerance. Let's break down the options:

The Three Main Strategies

Equity REITs: Own the Buildings (90% of the market)

These REITs actually own and operate physical properties—the apartment complexes, warehouses, and shopping centers you see around you. They make money by collecting rent from tenants.

Best for: Steady income plus potential property appreciation

Mortgage REITs: Finance the Deals

Instead of owning buildings, these REITs act like banks—they provide financing by purchasing mortgages and mortgage-backed securities. They earn money from the interest on these loans and typically offer higher yields than equity REITs, but they're more sensitive when interest rates change.

Best for: Maximum current income (but with higher volatility)

Hybrid REITs: Best of Both Worlds

These combine both strategies, owning some properties while also financing others.

Best for: Balanced diversification across real estate strategies

Property Sectors: Where Your Money Works

Think of REIT sectors like different neighborhoods in real estate—each has its own personality, growth drivers, and investment story. Here are the five strongest sectors for EquityEarn investors:

🏭 Industrial & Logistics REITs

What they own: Warehouses, distribution centers, fulfillment facilities

Why they're attractive: Every time you order something online, it moves through these buildings. E-commerce growth drives consistent demand, and these facilities are expensive and time-consuming to build—creating natural barriers to competition. The shift to online shopping isn't reversing, making this one of the most dependable sectors.

🏘️ Residential REITs

What they own: Apartment buildings, student housing, manufactured home communities

Why they're attractive: People always need a place to live, making these recession-resistant. Population growth and housing shortages in many markets provide steady tailwinds. Plus, rents typically rise with inflation, protecting your purchasing power. When the economy gets shaky, residential REITs tend to hold up better than most other sectors.

💾 Data Center REITs

What they own: Facilities that house computer servers, cloud infrastructure, and data storage

Why they're attractive: Digital transformation, cloud computing, AI, and streaming create insatiable demand for data storage. These are mission-critical facilities with high barriers to entry—you can't just build one anywhere. As more of the world moves online and AI adoption accelerates, these properties become increasingly essential infrastructure.

📡 Cell Tower & Infrastructure REITs

What they own: Cell towers, fiber optic networks, data transmission infrastructure

Why they're attractive: 5G rollout and increasing data usage drive demand. Wireless carriers sign long-term contracts (often 10-15 years) with built-in rent escalators, providing predictable income streams. These are essential infrastructure that's expensive to replicate, and carriers need more towers—not fewer—as data usage explodes.

🏥 Healthcare REITs

What they own: Senior living facilities, medical office buildings, hospitals, skilled nursing centers

Why they're attractive: The aging Baby Boomer generation creates massive demographic demand that will only grow stronger in coming decades. Healthcare tenants often sign long-term leases (10-15 years), providing predictable cash flows. These properties are also difficult to convert to other uses, reducing competition and supporting stable occupancy.

How to Access REITs: Trading Structures

Publicly Traded REITs ✅

These are listed on major stock exchanges like the NYSE and NASDAQ. You can buy and sell them as easily as any stock, see transparent pricing throughout the day, and access them with minimal investment. This is what EquityEarn uses—giving you liquidity and flexibility.

Public Non-Traded REITs ⚠️

These are registered with the SEC but don't trade on exchanges. They're harder to sell quickly and typically less suitable for EquityEarn's strategy since you want flexibility.

Private REITs ❌

These are only available to accredited investors, require high minimums, and offer very limited liquidity. Not ideal for most investors using equity compensation as collateral.

The Equity Earn Advantage: Double-Dipping on Growth

Here's the powerful math behind using EquityEarn to invest in REITs:

Traditional Approach: Wait and Miss Out

Year 1-4: RSUs vest, earn $0 in income

Year 4: Sell $100K of vested RSUs

Year 4: Invest in REITs, start earning 5% yield ($5K/year)

Total income missed: ~$20K over 4 years

EquityEarn Approach: Earn Now, Keep Upside

Year 1: Use $100K unvested RSUs as collateral

Year 1: Borrow and invest in REITs earning 5% yield

Year 1-4: Earn $5K/year in REIT dividends ($20K total)

Year 4: RSUs vest at $150K (50% gain)

Year 4: Repay loan, keep your appreciated equity

Result: You earned $20K in dividends AND kept the $50K equity appreciation

You're not choosing between equity growth and REIT income—you get both.

Benefits of the EquityEarn + REIT Strategy

1. Immediate Income Generation

Start earning 3-7% annual yields today, not years from now when your equity vests.

2. No Opportunity Cost

Don't sacrifice your equity's upside potential. Keep it all while still generating income.

3. Diversification Without Selling

Spread risk across real estate sectors without liquidating your concentrated equity position.

4. Tax Efficiency

Borrowing isn't a taxable event. Your RSUs continue to vest on their normal schedule.

5. Professional Real Estate Exposure

Access institutional-quality properties managed by experienced teams—no landlord headaches.

6. Inflation Protection

Real estate and rents typically rise with inflation, protecting your purchasing power.

7. Liquidity When You Need It

REIT dividends provide regular cash flow for living expenses, reducing the need to sell equity prematurely.

Understanding REIT Returns

Dividend Yield

The annual dividend divided by the current share price. REIT yields typically range from 3-7%.

Example: A REIT trading at $50/share paying $3/year in dividends has a 6% yield.

Total Return

Dividend yield + price appreciation.

Historical performance: REITs have delivered average annual total returns of 9-12% over long periods, comparable to broader stock market returns but with lower correlation.

Why REITs Pay High Dividends

By law, REITs must distribute at least 90% of taxable income as dividends. This creates reliable income streams for investors.

Building Your REIT Strategy with EquityEarn

Step 1: Assess Your Collateral

Determine how much unvested equity you have that can be used as collateral.

Step 2: Define Your Goals

Maximum income: Focus on higher-yielding REITs (mortgage REITs, healthcare, retail)

Growth + income: Balance between industrial, data centers, and residential

Conservative income: Stick with diversified REIT ETFs or blue-chip equity REITs

Step 3: Diversify Across Sectors

Don't put all borrowed funds into one property type. Consider:

20-30% Industrial/Logistics

20-30% Residential

15-20% Healthcare

15-20% Data Centers/Infrastructure

10-15% Self-Storage

5-10% Specialty/Opportunistic

Step 4: Reinvest or Spend Dividends

Compound growth: Reinvest dividends to acquire more REIT shares

Current income: Use dividends for living expenses or other investments

Hybrid: Reinvest some, spend some

Step 5: Monitor and Rebalance

Review quarterly, but don't overreact to volatility. Focus on:

Dividend sustainability

Occupancy trends

Management quality

Sector outlook

Real-World Example: The Power of EquityEarn + REITs

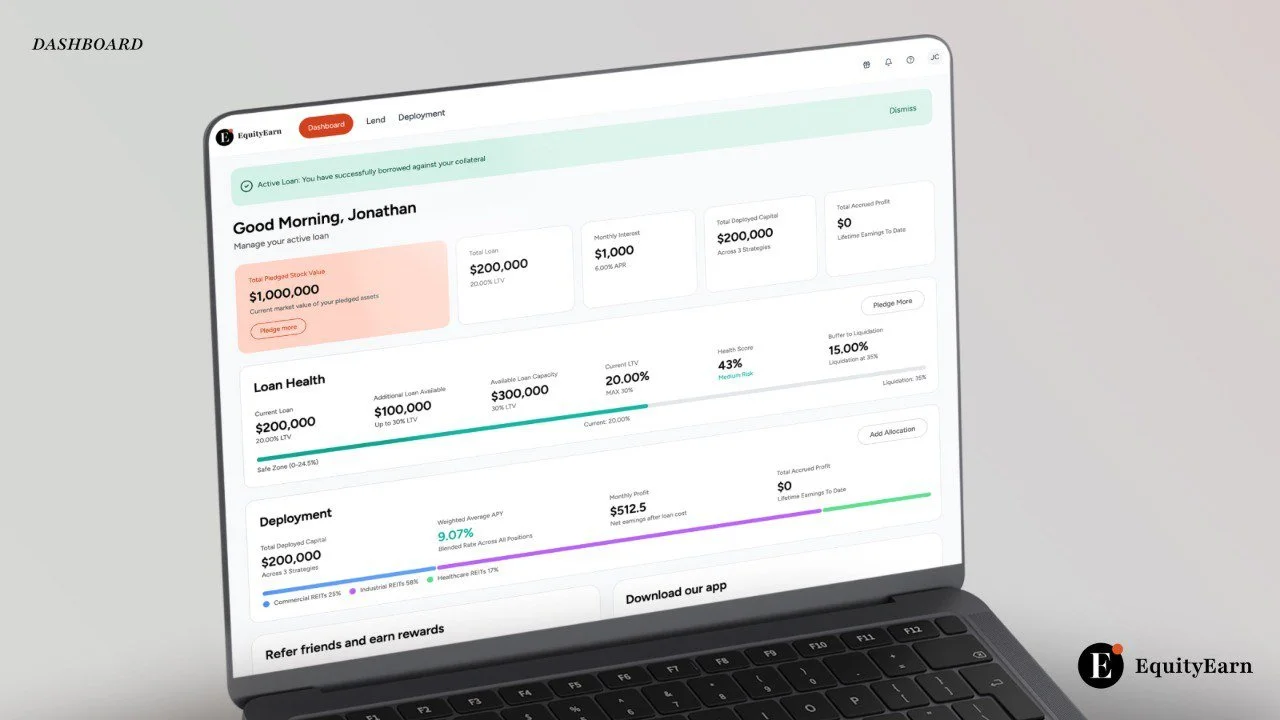

Meet Sarah: Tech employee with $200K in RSUs vesting over 4 years

Traditional Path:

Years 1-4: Wait for vesting, earn $0 income from equity

Year 4: Sell $200K in vested stock (now worth $280K with appreciation)

Year 4: Invest in REITs earning 5% yield

Total 4-year income: $0

EquityEarn Path:

Year 1: Use $200K unvested RSUs as collateral

Year 1: Borrow $120K, invest in diversified REIT portfolio

Years 1-4: Earn $6K/year in REIT dividends ($24K total)

Year 4: RSUs vest at $280K

Year 4: Repay $120K loan, keep $160K in appreciated equity

Year 4: Still own $120K in REITs generating $6K/year ongoing

Total 4-year income: $24K + ongoing dividend stream

Sarah earned an extra $24,000 while maintaining her equity upside. That's the EquityEarn advantage.

Common Mistakes to Avoid

1. Chasing Yield Alone

An 10% yield might signal distress, not opportunity. Focus on sustainability.

2. Ignoring Property Quality

Location, tenant strength, and property condition matter enormously.

3. Over-Concentrating

Don't put all funds into one REIT or sector. Diversify.

4. Panic Selling During Volatility

REIT prices fluctuate, but dividends often remain stable. Focus on income, not daily price swings.

5. Forgetting About Management

Quality management teams make all the difference in navigating challenges.

6. Neglecting Your Underlying Equity

Monitor your vesting equity too—if its value drops significantly, you may need to adjust your strategy.

Getting Started with EquityEarn

Ready to unlock the income potential of your equity compensation?

The Process:

Apply: Submit your equity compensation details

Get approved: EquityEarn evaluates your collateral

Choose your REITs: Select from curated options or build a custom portfolio

Start earning: Begin receiving REIT dividends immediately

Keep your upside: Your equity continues to vest and appreciate

What You'll Need:

Vesting equity compensation (RSUs, stock options, or equity grants)

Employment verification

Basic financial information

The Bottom Line: Don't Leave Money on the Table

Your equity compensation is valuable—but it shouldn't force you to choose between growth and income. With EquityEarn, you can:

✅ Generate immediate cash flow from high-quality REITs

✅ Maintain 100% upside potential in your vesting equity

✅ Diversify without selling your concentrated position

✅ Build wealth through multiple streams simultaneously

The question isn't whether you should invest in REITs. It's whether you can afford to wait years before starting.

Ready to unlock your equity's earning potential? EquityEarn helps equity compensation holders access REIT income today without sacrificing tomorrow's growth. Start earning the yields you deserve.